Whether an HDHP is the right choice for you depends on your healthcare needs and comfort with some risk. Nora Carol Photography/Getty Images

Health Savings Account contribution limits will rise in 2026. Here’s what federal employees need to know about High-Deductible Health Plans

For many federal employees, an HDHP can be the most cost-effective plan option.

The IRS recently announced an increase in Health Savings Account contribution limits for 2026. Individuals enrolled in a High-Deductible Health Plan with self-only coverage will be able to contribute up to $4,400 next year—$100 more than the 2025 limit. Those with self plus one or self and family coverage can contribute up to $8,750 in 2026, a $200 increase. HDHPs paired with an HSA are often among the lowest-cost options in the FEHB program, offering a valuable way to save for both current and future healthcare expenses.

To help you determine if an HDHP could be a smart financial choice for you, here’s a primer.

How HDHPs work

As the name suggests, HDHPs have much higher deductibles than most PPO or HMO plans available in the FEHB program. Self-only enrollees will see deductibles ranging from $1,650 to $2,000 per year depending on the plan and self plus one and self and family enrollees will see deductibles ranging from $3,300 to $4,000 per year.

One common frustration with HDHPs is the lack of transparency around out-of-pocket costs for medical services. Before meeting your deductible, you're responsible for paying the full allowed charge for most medical services—but these charges are not listed in the plan brochure or marketing materials. To get an estimate, you’ll need to contact the plan directly and inquire about the cost for services from an in-network provider. After meeting the deductible, many HDHPs require you to pay a small percentage of the service cost, known as coinsurance. Unfortunately, this still leaves you in the dark about the exact amount you’ll owe, since the total service cost isn’t disclosed. However, some HDHPs offer fixed copayments for services once the deductible has been met, which can make costs more predictable.

Preventive services are covered at no cost in HDHPs, both before and after you meet the deductible, if you use in-network providers. These services typically include routine physicals, well-child visits, immunizations, screenings, and mammograms—all aimed at supporting long-term health and early detection.

HSA Contributions

To help offset the high deductible, HDHPs include contributions to an HSA, which plan members can use to pay for eligible out-of-pocket healthcare expenses. The amount contributed to your HSA depends on the specific plan and your enrollment type. For self-only coverage, annual contributions typically range from $800 to $1,200. For self plus one or family coverage, contributions range from $1,600 to $2,400 per year.

These contributions are provided as a monthly premium pass-through. For example, if you're enrolled as self and family in an HDHP that offers a $2,400 annual HSA contribution, you would receive $200 in your HSA each month.

Each HDHP designates a financial institution to manage its HSA. Enrollees have the option to invest their HSA funds, with investment choices similar to those available in Individual Retirement Accounts. Additionally, HSAs are fully portable—if you switch to a different FEHB plan during a future Open Season, your HSA funds remain yours to keep and use, regardless of your new coverage.

Triple Tax Savings on Voluntary HSA contributions

For those who can afford to make additional contributions to their HSA, the tax benefits are substantial. When you contribute to an HSA through your paycheck, the money is taken out before taxes, which means you’ll owe less in income taxes. In addition, any investment gains within the HSA grow tax-free. Finally, withdrawals used for qualified healthcare expenses are also tax-free—making the HSA one of the few savings vehicles with triple tax advantages.

You can take money out of your HSA for non-medical expenses, but there are tax consequences. If you make a non-medical withdrawal before age 65, you’ll owe regular income tax on the amount, plus a 20% penalty. After you turn 65, the penalty no longer applies—you’ll only pay regular income tax on non-medical withdrawals, similar to distributions from a traditional IRA.

How to Maximize Your HSA

To maximize the potential of your HSA, you’ll want to try and preserve the plan contributions. Here are two ways that you can do that.

While IRS rules prohibit HDHP enrollees with an HSA from also having a standard Health Care Flexible Spending Account, they are allowed to enroll in a Limited Expense Health Care FSA specifically for dental and vision expenses. This account allows you to use pre-tax dollars to pay for qualified dental and vision expenses, typically resulting in savings of around 30%. At the same time, it enables you to leave your HSA funds untouched—allowing them to remain invested and growing over time.

HDHPs typically have lower premiums than many PPO and HMO plans in the FEHB program. If you switch to an HDHP, it might be tempting to treat the premium savings as extra take-home pay. Instead, consider contributing those savings to your HSA. Since you’ve already budgeted for a higher FEHB premium, redirecting the difference into your HSA won't impact your finances—and it allows you to withdraw your own contributions first if you need to pay for a healthcare expense. This approach lets the plan’s HSA contributions remain invested, giving them more time to grow tax-free over the long term.

How much money can you save enrolling in an HDHP?

There are two features of HDHPs that tend to produce savings compared to many other HMO and PPO plans in FEHB, lower premiums and plan funded HSA contributions. Depending on your current FEHB plan and enrollment type, there are substantial savings available to many federal employees.

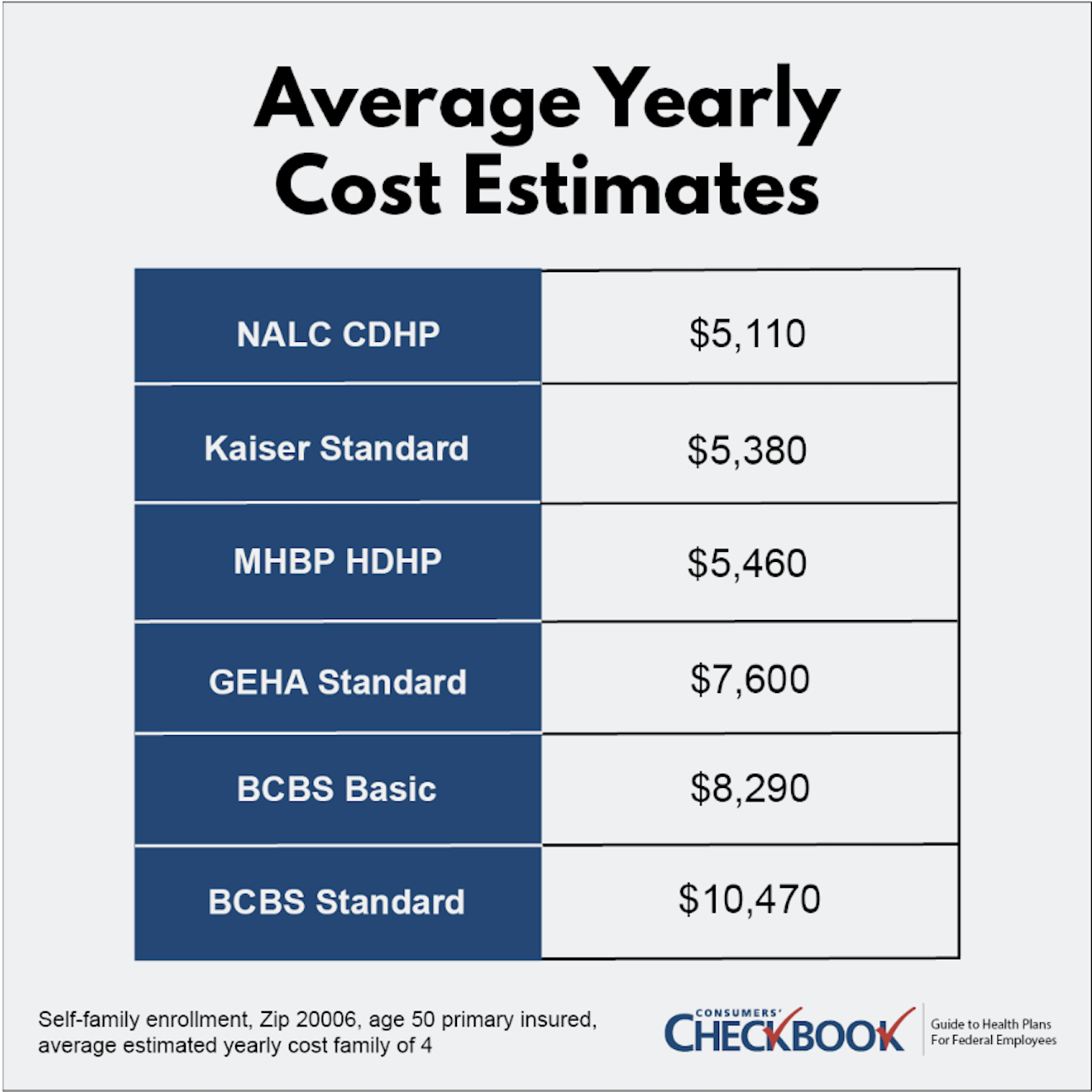

Checkbook’s Guide to Health Plans for 47 years has ranked plans on estimated yearly cost based on user information—age, family size, and expected healthcare usage, to help federal employees and annuitants see which plans offer the most value.

A family of four in the Washington, D.C., area, with average healthcare expenses and a primary policyholder aged 50, could save $5,010/year by switching from BCBS Standard to MHBP HDHP.

Who shouldn’t consider HDHPs?

HDHPs may not be the best choice for individuals with high expected healthcare usage. Before meeting the deductible, you’ll be responsible for paying the full allowed cost of non-preventive care services, and even after meeting the deductible, you’ll still pay either coinsurance or a copay. Those who frequently use medical services may prefer a plan with higher premiums in exchange for greater predictability—such as fixed copays and no deductible—which are available in some FEHB plans.

HDHPs may also be less suitable for risk-averse individuals due to two types of risk. The first is the risk of high out-of-pocket costs. For example, if you're new to an HDHP and experience an unexpected hospitalization early in the year, you could be responsible for the full deductible plus additional coinsurance or copays—without having accumulated much in HSA contributions from the plan. In contrast, several FEHB plans offer low or no deductibles along with fixed inpatient hospital copays, resulting in lower out-of-pocket costs in such scenarios.

The second risk is investment-related. Since HSA funds can be invested, there's always the possibility of market losses. If your investments perform poorly, you may have less money available to cover out-of-pocket expenses when you need it.

The Final Word

For many federal employees, an HDHP can be the most cost-effective plan option. Whether it’s the right choice for you depends on your healthcare needs and comfort with some risk. Employees who remain enrolled in an HDHP over several years—and are able to preserve the plan’s HSA contributions while making additional contributions—can accumulate significant savings to cover both current and future healthcare expenses.

However, it’s important to note that the tax advantages of HSAs are only available until you enroll in Medicare. Once enrolled in Medicare, you can no longer receive HSA contributions from your plan or make voluntary contributions to the account.

With higher HSA contribution limits coming next year, there’s an even greater savings opportunity. Be sure to review HDHP options during Open Season to determine if this type of plan can help you save both now and in the long run.

Kevin Moss is a senior editor with the Guide to Health Plans for Federal Employees provided by Consumers’ Checkbook. Watch more of his free advice and check here to see if the Guide is available for free from your agency. You can also purchase the Guide and save 20% with promo code GOVEXEC.